Downer buys up Tenix in $300m move

Mine engineering and services contractor Tenix has been sold to Downer EDI for $300 million.

Mine engineering and services contractor Tenix has been sold to Downer EDI for $300 million.

The deal was signed this week, with Tenix chairman Paul Salteri saying in a memo to staff; "The decision to sell the business to Downer Group has been difficult for shareholders, as we believed the business is well positioned in its markets to take advantage of exciting growth opportunities.”

“Downer Group is a leading Australia player in the engineering and services sector, and it is my understanding in discussions with their CEO that they will be looking to Tenix as a strategic growth platform into the power, gas & water sectors. Accordingly this will create exciting opportunities for all Tenix staff,” he said.

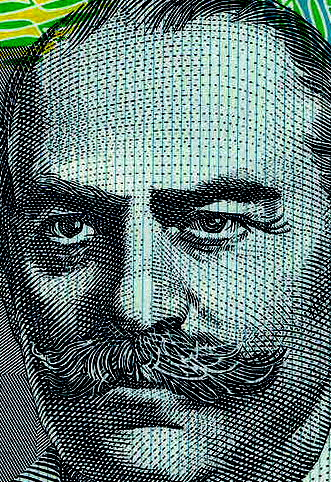

Many will know the Salteri name from other ventures. The family that built its fortune on the success of the Transfield Group, founded by the late Carlo Salteri and Franco Belgiorno-Nettis in 1956.

The defence-contracting arm of Tenix was sold for $775 million in 2008 to British giant BAE Systems, but it is understood that the significant transport infrastructure services that Tenix retained are the main target of the new buy-out.

There has been renewed interest among business circles in the purchase of contracting firms, as several large infrastructure projects will need building in the coming decade.

Downer chief Grant Fenn told Fairfax Media that Tenix fitted Downer's strategy of acquisitions that “are strategic, grow our capabilities and the right price”.

“There is little overlap between the two companies and Tenix will be foundation for a new core utilities business for Downer,” he said.

Print

Print